3 months ago, Sri Trang still have allocation at below USD5.00 per box. Now even buyers offer more than USD7.00, there zero allocation. Gloves business definitely not for the faint heart or buyer with much conservative approach.

Before the gameplay for buyer. This is the background.

It been almost 2 months we made a call to set up an operational team in Thailand to expand into the glove business in Thailand.

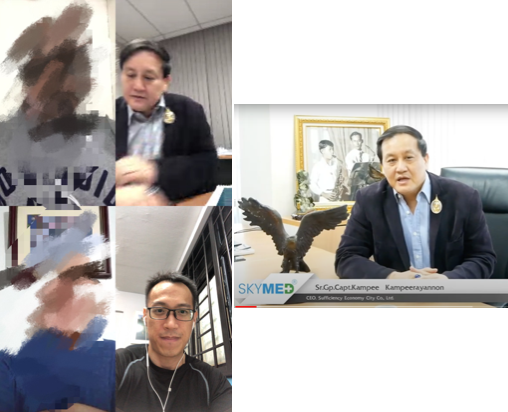

Special thanks to our partner, Mr Ye, whom manages a team in Thailand to visit gloves factories, warehouses, sales representative office to do due diligence. He also act as an interpreter for us to discuss terms with CEO, directors, heads of operation of glove players in Thailand.

Similarly to Malaysia or Vietnam, most of the reputable glove players are in maximum capacity, zero allocation for buyers. Shun Thai, Sri Trang, Wa RubberMate, Phoenix Rubber are some of the notable factory that is more than 10 years in gloves manufacturing history. I am sure you have noticed there is some common words in their website like "Frauds" "Scams" "beware"

This is their way to steer clear of their conscious against reseller claims, you could unveal more in our sharing “Darket Secrets of the Glove Business"

Because of the huge demands for gloves, many glove brands are evolved. for example Biotech, MOD, AE, NC, SKYMED just to name a few.

Some of the brands are set up by owners with strong backgrounds that could move resources. Others are trend followers trying to get a piece of the market.

These brands have many in common. For bigger ones, they have warehouse, decently decorated sales office and OEM factory with near complete certification. The distinct feature is that they do not own factories to manufacture for their brand. The way they do business is 1. Price lower than current market price 2. Collect 30-50-70% downpayment of the total allotment 3. Process of building factories for future production They are buying time from client's funds to build own factory. Some has shown us the production site in construction in pictures/videos. Other brand owners enter talks with us to supply them gloves machinery and allowed site inspection.

Machinery installation and production run could take up to 3-6months. This is why currently in Aug, Sep, Oct there is little glove allocation in the market. OEM factories near max capacity running for brand owners, big factories allocation is already full till 1st quarter of next year. From below USD5.00 in Jun to now near USD7.00 (Thailand production stock), ex-stock of more than USD7.5. There is high chance of no stopping of price going up even after production ramp up in 3 months later. Hence, buyer can consider the following GamePlay 1. Buy from major brands Pursue with relentless due diligence. Work with consultative partners who can assist you on the grounds to negotiate hard, walk you through every single process of the deal.

We led our client to the CEO of brand owners, assisted to negotiate the terms and conditions. We led the discussion to the brand owner management team incharge to establish fair deal between buyer and seller. Holding the hands of buyer, we raise impending red flags, advise suitable terms and conditions. Excelus do not favour sides, we speak the unpalatable hard truth. We tell our buyer off for imposing a 15% penalty clause in which market norms is 2% It has to be a win-win not win-lose. Although buyer holds the call, seller faces huge production, material cost, logistic risk. Hence as a consultative partner, buyer and sellers entrusted Excelus to deal. PROs: a. Fast turnaround time to meet buyer required qty b. 1st mover advantage to own gloves - when brands owners glove production factory are set up, they will garner more influence and reputation to raise price. c. Establish good working relationship to leverage for future deals offering before brands owner gain traction to maxed up allocation. CONs: a. Risk of late delivery - as brand owners do not have own production capacity, they are at the mercy of OEM factories b. Risk of claims - brand owners may exaggerate their claims of stock ownership, production capability, influence on OEM factory.

2. Invest in Production Capability Some brands are open for discussion for buyer to invest in their production lines. Instead of a buy/sell relationship, they are willing to offer proposal to buyers with possible exclusive production lines for glove below market rate. Excelus assists buyers to enter into such negotiation. PROs: a. Partake in closer relationship with seller - buyer becomes investor and commands stronger influence on sellers on deal making b. Unwavering in supply squeeze - buyers own production line that project clear production schedule. - buyer could easily resell the gloves for good profits CONs: a. Lack of expertise - buyer reliance on technical expertise of seller on production capability make investment one-sided. b. 3-5 months Lead - machinery installation takes more than 90days, excluding machine delivery time, fine tuning of machinery to start production. 3. Wait for increased allocation This is only for the faint heart that could lead to heart attack later for knowing glove price jumps again after possible increase in allocation in Oct period. As there is no lacking in demand, any stocks from major factory are snatched immediately, and allocation bid up to highest price just to get to the stock. Waiting for increased allocation will end up to no gloves and nothing gain for buyer.

No Venture no Gain. Play a just win-win game.

Comments